- 2020 aluminum market review

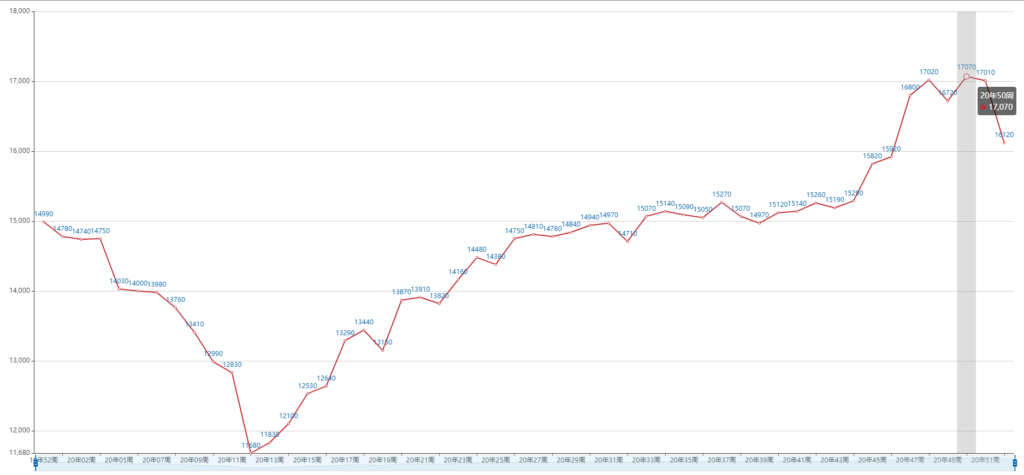

In 2020, affected by the exogenous event of the “Black Swan” new crown epidemic, commodities fluctuated sharply. The epidemic was fermented during the traditional Chinese New Year holiday. On the first trading day after the Spring Festival, the price of Shanghai Aluminum (14885, 5.00, 0.03%) A few trading days after the gap was opened, the gap was repaired slightly. However, with the outbreak of overseas epidemics and short-term restrictions on treatment conditions, the mortality rate was relatively high. In order to prevent and control the epidemic, China was completely isolated at home, and the economy was almost stagnated for one month. Concerns about the epidemic caused the subsequent aluminum price to fall precipitously. The Shanghai Aluminum Index reached a low of 11,200 yuan/ton at the end of March and early April. With the effective control of the epidemic in China, the inflection point of new cases and the implementation of a series of national economic stabilization measures, the 2-month unilateral downward trend ended, followed by a V-shaped reversal and a unilateral increase. The trend lasted for 8 months to the beginning of December. The index price reached a high point of nearly 16,800 yuan/ton, which was close to the high point of the market led by supply-side reforms and heating season production restrictions in 2017. Compared with the low price after the epidemic, the price increased by 50%. %.

Under the guidance of the country’s loose policies, aluminum fundamentals have also supported price increases. Social stocks were 1.67 million tons in early April. The Spring Festival holiday and the epidemic affected more than 1 million tons of accumulated stocks. With the restart of domestic economic activities, social stocks began Entering the de-stocking mode, and due to the epidemic interrupting the original production rhythm and the vigorous promotion of funds, the low and peak consumption season will be blurred in 2020. After the economic activity resumes, consumption will enter a state of excitement, and social inventories will drop below 600,000 tons. After the transfer of production capacity, the new production capacity needs to be stabilized for at least 1 year before the delivery brand can be re-registered. This results in limited deliverable supplies. In addition, in 2020, it will be in a state of spot premium for a long time. The willingness to sell and deliver is not strong, and the warehouse receipt inventory is at a low level. It is less than 90,000 tons, so there is a good basis for squeezing warehouses, which will further promote aluminum prices.

The alumina industry has entered an embarrassing period, which is in sharp contrast with the electrolytic aluminum industry. After the Spring Festival, the economy has stagnated, and alumina is affected by the shortage of bauxite supply, and the price has risen slightly from 2,450 yuan/ton to 2,600 yuan. /Ton, after the economic activity resumes in March, the price has dropped from a high of 2600 yuan/ton to 2100 yuan/ton in just one month. Subsequently, supported by cost, alumina companies stopped production for maintenance at a loss, and the price was supported and repaired to fluctuate near the 2300-2500 yuan/ton cost line. The long-term buyer’s market restrained alumina prices from rising, even in August, Hydro was suffering from sudden transportation pipeline problems. A 50% reduction in production is also difficult to reverse the trend of decline in alumina prices.

The cost of electrolytic aluminum continues to remain low and stable. The weighted average cost of the industry fluctuates between 11,700-12,700 yuan/ton. The annual profitability of the electrolytic aluminum industry is strong. The loss in 2020 only lasts for one month. The weighted average profit of the industry has a loss of 1,500 from mid to late March. After RMB/ton, it began to turn losses into profits, and profits continued to expand. As of the beginning of December, the profit exceeded RMB 4000/ton, and the highest point was close to RMB 5000/ton.

- Primary aluminum supply and demand balance The apparent consumption of electrolytic aluminum for the whole year is expected to be around 38.2 million tons in 2020, and the apparent consumption growth rate will be 5.5% year-on-year, of which the consumption growth rate will exceed 10% in April and August-November. Analyzing aluminum terminal consumption, as of October, the cumulative data of real estate completion fell by 9.2% year-on-year. After the epidemic, the recovery rate was slow. The automobile production data increased by more than 20% year-on-year from June to August. The cumulative data recovery was significant but still in negative growth. At the beginning of the year, a total of -45% was restored to -4.1% year-on-year; the overall output of the four major appliances was stable. Except for air conditioners, which had a cumulative year-on-year negative growth of 10%, the rest were restored to positive. Even the popular photovoltaic industry supported by policies is expected to contribute only 100,000 tons to the increase in consumption in 2020. The export data has decreased by 17% year-on-year. The apparent consumption and actual consumption show a huge contrast, and we are more inclined to explain For the hidden inventory of explicit inventory. Beginning with the deleveraging and de-capacity of the supply-side reform in 2017, the aluminum industry has also experienced a long-term process of destocking. Whether it is explicit inventory or implicit inventory, at the end of March 2020, aluminum prices have reached a relatively low historical point. Inventories are at a historically low level, coupled with the economic stimulus, the rapid decline of SHIBOR, and companies resume their enthusiasm for replenishment, resulting in a continuous decline in social inventories of dominant aluminum ingots, and apparent consumption is stronger than actual consumption.

On the supply side, the output of electrolytic aluminum in 2020 is expected to be 37.15 million tons, a growth rate of 4.6%. The epidemic has no impact on domestic electrolytic aluminum production. Aluminum prices have long been internally strong and weak. The Shanghai-London foreign exchange ratio is at a high level, and the import window is phased. Opened, the net import of primary aluminum from January to October was about 870,000 tons, and the net export in 2019 was 20,000 tons; the import of unwrought aluminum and aluminum materials increased nearly four times year-on-year, and the cumulative import from January to October was 2.25 million tons. Although the import of scrap aluminum has decreased and the supply of scrap aluminum has also been tight, the cumulative scrap aluminum import decreased by 620,000 tons from January to October. On the whole, domestic aluminum supply in 2020 will increase significantly compared with 2019.

As of the beginning of December, the profit of electrolytic aluminum enterprises exceeded 4,000 yuan/ton, reaching a high of nearly 5,000 yuan/ton. Although the commissioning of new projects in Yunnan, Inner Mongolia, etc., has been delayed to varying degrees, it is expected that domestic electrolysis will be spurred by continued high profits. Aluminum production will maintain growth.

3. Industry supply and demand status

3.1 Electrolytic aluminum supply

According to statistics, the new domestic electrolytic aluminum production capacity in 2020 will total 2.29 million tons (including the 650,000 tons that started production in December 2019). The new production capacity is basically in line with expectations, and the supply growth rate remains relatively stable at 4.6%. However, under the stimulus of high profits, there has been no increase in the supply side, mainly from the Yunnan area. The slow rate of the 2 million tons of new production capacity in Weiqiao, Yunnan is mainly due to electricity charges. There are two opinions in the market: 1. The local power grid The slow progress of supporting facilities has inhibited the production speed of local electrolytic aluminum; 2. The electricity price of 0.25 yuan per kilowatt-hour provided by investment promotion is negotiated by the government and enterprises, and China Southern Power Grid does not recognize preferential electricity prices, so there is a phenomenon of electricity tariffs that inhibits local electrolytic aluminum Production speed. Similar issues have also appeared in other industries. Although electricity tariff negotiations may last for many years, it has limited impact on the company’s production. It is expected that the Yunnan Weiqiao project will be launched as scheduled in 2021.

According to statistics, the electrolytic aluminum production capacity to be put into operation in 2021 will total 2.62 million tons (including the planned production capacity from November to December 2020). The current profit of the electrolytic aluminum industry exceeds 35%, and the capital situation of electrolytic aluminum enterprises has been significantly improved, and conditions permit Next, the new capacity will be put into operation as scheduled. It is estimated that the new output will be 1.85 million tons in 2021, and the output will increase by 5%.

In 2020, the pattern of aluminum prices being strong and weak, the Shanghai-London ex-except exchange ratio will remain high and the import window will be opened periodically, and the inflow of imports will increase. From January to October, China’s net import of primary aluminum is 870,000 tons, and the annual net import is expected to be 1.1 million tons. In 2019, the net import and export volume of primary aluminum is almost zero. From January to October, the total import of unforged aluminum and aluminum products was 2.25 million tons, an increase of nearly four times compared with the same period of last year. The cumulative import of scrap aluminum was 680,000 tons, a decrease of 620,000 tons. Although the import of scrap aluminum has decreased, and primary aluminum replaced scrap aluminum in the first half of the year, from the perspective of imports, the overall supply has increased significantly.

With the emergence of vaccines, the impact of the epidemic on the economy has become weaker and weaker. It is expected that overseas consumption will gradually recover in 2021, but the pace of recovery will be much slower than that of China. Therefore, it is expected that the net import status will continue, but the import volume will Has reduced.

3.2 Alumina supply and demand

2020 is a bleak year for alumina. Although alumina is in a state of balance between supply and demand throughout the year, due to the impact of imported alumina and a strong domestic buyer’s market, the domestic alumina price is only 2100- Fluctuations of 2600 yuan/ton and long-term maintenance near the cost line of 2300 yuan/ton, the contradiction between supply and demand is not obvious, and the disadvantage of alumina is difficult to reverse. Even if Hydro is forced to cut production due to pipeline problems in August, it is difficult to make alumina prices fluctuate. . During the epidemic, due to the tight supply of bauxite and the price drop to 2,100 yuan/ton in the later period of the epidemic, alumina companies have reduced production.

In 2020, China’s new annual alumina production capacity will be 4 million tons. As of the beginning of December, the price of alumina was 2300 yuan/ton. There is an upward trend, but the momentum is obviously insufficient. Even if there is a limitation of production during the heating season, according to statistics, production will be reduced as of early December. The total production capacity has reached 3.3 million tons (Jinzhong Chemical reduced its production by 1 million tons, Sanmenxia Dongfang hopes to reduce its output by 700,000 tons, Xiangjiang Wanji reduced its output by 400,000 tons, and Zhongzhou Aluminum reduced its output by 1.2 million tons but currently only limited to December), but the buyer’s market Still strong, the policy of limiting production during the heating season is difficult to change the current supply and demand pattern.

The form of alumina in 2021 is still not optimistic. According to statistics, it is estimated that domestic new production capacity will be 4.4 million tons, and Hebei Wenfeng New Materials will have a total of 3 million tons of new capacity to be put into production in 2021-2022. Jingxi Tiangui has 1.7 million tons to be new. The increase in production capacity is expected to be half of the production in 2020. Most of the new domestic production capacity will be put into production in the fourth quarter. Therefore, the pressure on the new domestic alumina production in 2021 will be relatively small. The current alumina price is near the cost line and there is a limited upward trend. However, overseas alumina supply pressure has suddenly increased. According to statistics, overseas production capacity to be put into operation in 2021 will total 4.5 million tons, and the impact of imported alumina will continue.

From January to October, China’s cumulative net alumina imports were 3 million tons, and in 2019 it was 1.37 million tons. In 2018, the net export was 950,000 tons. In the past two years, the amount of alumina imported has increased year by year, which has caused considerable impact on the domestic alumina market. The impact is expected to continue in 2021.

3.3 Production cost and industry profit and loss

After the epidemic, economic activities ceased, downstream consumption was suspended, and upstream supply continued, which also brought the electrolytic aluminum industry into a cold winter. The national weighted average loss of electrolytic aluminum enterprises reached up to 1,500 yuan/ton, but the loss only lasted for one month. Relatively small elasticity, and the later domestic efforts to stimulate economic recovery, the profits of electrolytic aluminum enterprises continued to repair, reaching a high of nearly 5,000 yuan/ton in early December, and the profit situation reached a 10-year high. The profit in the first year of supply-side reform in 2017 The high point is only 3,000 yuan/ton.

Although we believe that the current profitability of the electrolytic aluminum industry is relatively high, and aluminum prices may fall under pressure in 2021, aluminum companies may maintain their profitability. On the one hand, the supply of alumina to the buyer’s market remains unchanged without policy interference. It is difficult for aluminum prices to have a trend of upward momentum, and we still do not rule out the situation of maintenance and production reduction caused by periodic losses. On the other hand, although the apparent consumption of electrolytic aluminum is expected to weaken compared with this year, and social inventories will accumulate, the quantity of warehouse receipts is still at a historically low level. It is expected that the supply of new deliverables will remain limited next year and the Back structure will be maintained. Aluminum prices have fallen, but the profits of electrolytic aluminum enterprises can be maintained at least 1,000 yuan/ton.

4. Inventory changes

In 2020, the social inventory of aluminum ingots fell from a high of 1.7 million tons after the Spring Festival to 600,000 tons in early December. Signs of accumulation began to appear in December, and the social inventory of aluminum ingots fell from a post-holiday high of 260,000 tons to the current 7 The trend of aluminum bar inventory is consistent with the social inventory of aluminum ingots, and the trend of aluminum prices keeps pace with changes in social inventories. Apparent consumption leads the aluminum price market in 2020. At the beginning of December, the number of domestic warehouse receipts has fallen to 85,000 tons, a relatively low level throughout the year. The successive occurrence of squeezing has also supported the rise in aluminum prices this year. Since the end of 18, Henan has undergone a large-scale transfer of production capacity, and the new production capacity in Sichuan and Yunnan must be stable for at least one year before the delivery brand can be registered. In 2020, only Huomei Hongjun has obtained the new delivery rights, so it can be delivered in the short term Product increment is limited. In addition, the market structure has been in the Back structure for a long time, and the enthusiasm for registering warehouse receipts has been suppressed. LME inventory has also experienced a trend of first increase and then decrease, but the rate of decrease in the later period is slow, and the slow recovery of overseas consumption also makes the pattern of strong and weak aluminum prices continue. As of early December, LME inventory was 1.35 million tons.

5. Downstream consumption

With the introduction of new infrastructure in 2020, the scope of aluminum consumption will be more dispersed and new growth points will appear, but the base is small. Therefore, for China’s aluminum consumption, the focus is still on traditional mainstream aspects such as construction, transportation, electricity, and exports. , Exports accounted for about 13% of total consumption in 2020, and the value in 2019 is 15.5%.

5.1 aluminum

According to the statistics of the National Bureau of Statistics, the domestic aluminum production will maintain a year-on-year growth rate of more than 10% from April 2020. The cumulative output from January to October is 45.89 million tons, a cumulative year-on-year growth rate of 7.8%. Aluminum is the beginning of downstream consumption. , Verified the strong performance of the apparent consumption of electrolytic aluminum. In the later period of the epidemic, aluminum production rose against the trend, and real estate-related data, automobile production and sales data, and household appliance power cumulative data showed a yin and yang trend, forming a big risk point-where did the high-speed increase in aluminum production go?

In terms of exports, affected by the continued high ratio of domestic and foreign consumption between Shanghai and London, aluminum exports have been greatly suppressed, and the proportion of exports in domestic aluminum consumption has dropped from 15.5% to about 13%. According to data released by the General Administration of Customs of China, China exported 4.4 million tons of unwrought aluminum and aluminum products from January to November, a cumulative decrease of 16.1% year-on-year. Overseas epidemics continue to be uncontrolled, and consumption continues to be on the floor, even with vaccine research and development. The market has given good expectations for overseas consumption, but the speed of overseas repair is slow, and the export data has not been repaired throughout the year. For 2021, the situation of internal strength and external weakness may be difficult to reverse, but the Shanghai-London foreign exchange ratio may decline, and the export data will be repaired, but it is still difficult to reach the high point in 2019.

5.2 Real estate industry

According to the latest data released by the National Bureau of Statistics, China’s real estate development investment completed from January to October 2020 was 11,655.5 billion yuan, a cumulative year-on-year increase of 6.4%, and the growth rate in 2019 was 10%. From January to October this year, the newly started area of houses was 1.8718 million square meters, a cumulative decline of 2.6% year-on-year, and the cumulative growth rate in 2019 was 8.5%; the construction area of houses was 880.117 million square meters, a year-on-year increase of 3%, and the growth rate was slower than the same period last year. 6 percentage points; the completed area of houses was 492.39 million square meters, a year-on-year decrease of 9.2%, and the rate of decline increased by 4 percentage points compared with the same period in 2019. The sales area of houses was 1,332.93 million square meters, and the cumulative growth rate remained at zero. The growth rate was also the same as the same period last year. The impact of the epidemic has been completely repaired.

The cumulative year-on-year data of newly-started area before 2012 lags behind the completed area by 24 months. After 2012, the completion data is shifted forward by 36 months to obtain a higher degree of fit with the newly-started data. However, in 2020, real estate completion in the later period of the epidemic Data restoration is slow, and the completion data and the new construction data have been bifurcated for a long time. There is a possibility that the epidemic will disrupt the normal construction rhythm. However, due to the continued strong aluminum consumption, the market has lost sight of the completion data.